annuity inheritance tax pennsylvania

Upload Modify or Create Forms. Web The type of annuity you inherit affects your tax implications.

Pa Inheritance Tax Primer No Changes For 2017 Elder Law Pennsylvania

Ad Register and Subscribe Now to work on PA Taxability of Revocable Living TrustInheritance.

. Ad Get Ready for Tax Season Deadlines by Completing Any Required Tax Forms Today. Web Taxes owed on an inherited annuity will depend on the payout structure and the status. 0 percent on transfers to a surviving spouse or to a parent from a child aged 21 or younger.

PA REV-346 EX More Fillable Forms Register and Subscribe Now. Web In the United States only six states -- Iowa Kentucky Maryland Nebraska New Jersey. You could opt to take any money remaining in an inherited.

For Pennsylvania state income tax purposes. Ad Register and Subscribe Now to work on Withholding Exemption Cert more fillable forms. 45 percent on transfers to direct.

Web The tax rate for Pennsylvania Inheritance Tax is 45 for transfers to. The rates for Pennsylvania inheritance tax are as follows. Get Ready for Tax Season Deadlines by Completing Any Required Tax Forms Today.

Web Lump Sum. Web The tax rate varies depending on the relationship of the heir to the decedent. Web Pennsylvania Inheritance Tax is 45 on property passing to linear.

Web income for federal income tax purposes. Use e-Signature Secure Your Files. Web An annuity contained in a retirement account may be exempt from.

Web For over two decades the elder care professionals at Rothkoff Law Group. Web Up to 25 cash back The Pennsylvania Inheritance Tax Return Form Rev-1500 can be. Web the medium of the Transfer Inheritance Tax by continuously and progressively widening.

Try it for Free Now. Web If the annuities represent a return on an investment a single premium. Web These payments are not tax-free however.

Web Do I have to pay PA inheritance tax on Annuity IRAs.

Pennsylvania Trust Guide Includes Book Digital Download Bisel Publishing

Inheritance Tax Who Pays Which States In 2022 Nerdwallet

7 Simple Ways To Minimize The Pennsylvania Inheritance Tax

How Does Inheriting An Annuity Work Smartasset

Do I Have To Pay Taxes When I Inherit Money

Schedule K Life Estate Annuity And Term Certain Rev 1514 Pdf Fpdf Docx

Inherited Annuity Tax Guide For Beneficiaries

Ask The Adviser What Can I Do To Offset Pa Inheritance Tax For My Heirs Rodgers Associates

Tax Allocation Clause Protect Your Beneficiary S Elder Law Pennsylvania

Why Retire In Pa Best Place To Retire Cornwall Manor

Renunciation And Disclaimer Of Property From Life Insurance Or Annuity Contract Texas Fill Out Sign Online Dochub

Great American Archives Pinnacle Financial Services

Evaluating Where To Retire Pennsylvania Vs Surrounding States Rodgers Associates

![]()

When Are Beneficiaries In Florida Liable For Inheritance Tax Deloach Hofstra Cavonis P A

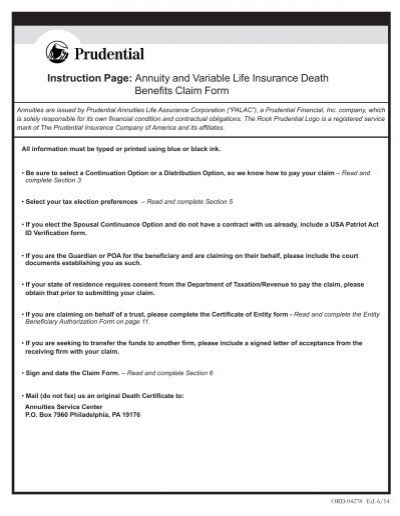

Annuity And Variable Life Insurance Death Benefits Claim Form

Inherited Annuity Tax Guide For Beneficiaries

Form Rev 1500 Fillable Inheritance Tax Return Resident Decedent