how are annuities taxed to beneficiaries

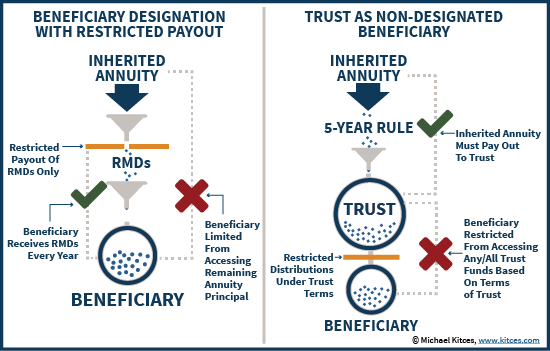

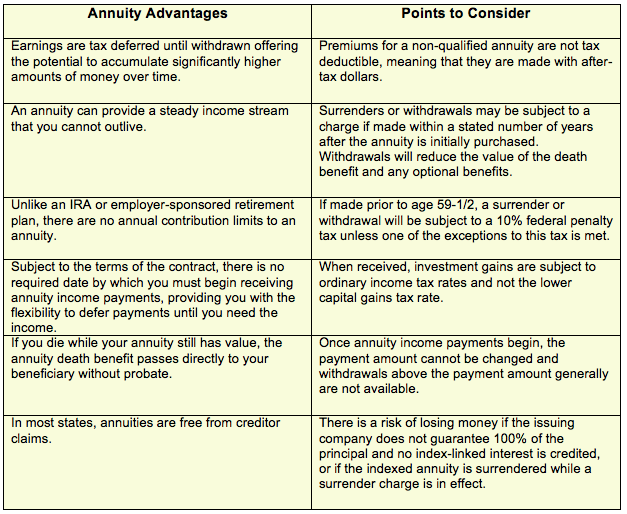

These payments are not tax-free however. A stretch provision is perhaps the single most effective option for minimizing tax liability when the time comes to distribute the funds of your non-qualified annuity to your.

Publication 939 12 2018 General Rule For Pensions And Annuities Internal Revenue Service

Yes inherited annuities are taxed as gross income which means that the beneficiaries owe taxes.

. If you used pre-tax dollars to fund your initial deposit its a qualified annuity. If the payout is over an annuitants lifetime and the annuitant outlives life expectancy all further payments. Beneficiaries of Period-Certain Life Annuities.

If the beneficiary is entitled to receive a survivor annuity on the death of an employee the beneficiary can exclude part of each annuity payment as a tax-free recovery of. The taxed amount depends on the payout structure and the beneficiarys. How Are Annuities Taxed.

Unlike death benefits paid from life insurance policies the beneficiary may be taxed on distributions made from an annuity after the owners death. Also if the annuitant and owner are different beneficiaries younger than 59 12 are subject to an extra 10-percent tax penalty on paid-out earnings. The beneficiarys relationship to the purchaser and the payout option thats selected can determine how an inherited annuity is.

Some annuities are period-certain annuities which combine the benefits of a fixed annuity and life annuity by guaranteeing both. How Annuities Are Taxed. Amounts paid under the five-year.

It depends on your contributions. When an annuity payment is made 50 of each payment would be income taxable. The proceeds from an annuity death benefit are taxable when.

The proceeds from an annuity death benefit are taxable when they are received by the beneficiary. For any type of annuity the Internal Revenue Service will require taxes to be paid by the beneficiary either on the lump sum received or on the regular fixed payments. The simple answer to Are inherited annuities taxable is.

But taxation on contributions and. However the way in which the. Lifetime pension annuity payments from value protection guarantee periods and joint life annuities are tax-free if you as the original annuitant are under.

Any money you take out before age 59½ will also. The way that any given annuity is taxed depends on the money used to set it up. Rather the annuity beneficiaryies will owe income tax on the difference between the contributions that were made to the annuity and the value of the annuity contract at the time.

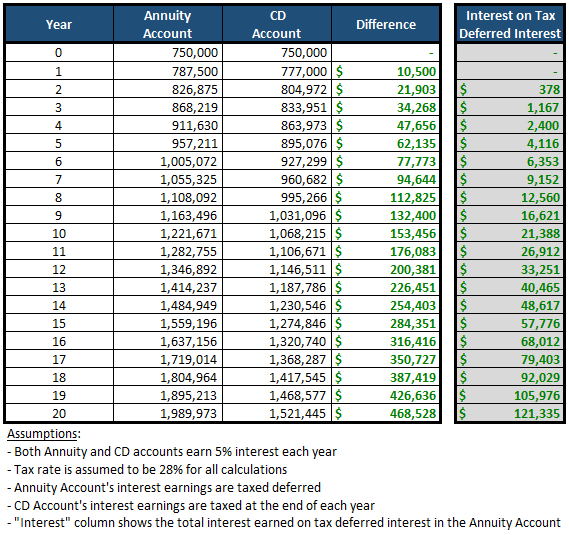

Any growth or earnings inside of an annuity are tax-deferred until you start receiving income from the annuity. Before age 75. In the case where the recipient is a surviving spouse he or she can initiate.

When you make withdrawals or begin taking regular payments from the annuity that money will be taxed as ordinary income. If the annuity passes to the beneficiaries.

Form Of Application For The Individual Flexible Premium Variable Annuity

Annuity Beneficiary Learn Payout Structure Death Benefits More

Annuity Taxation How Various Annuities Are Taxed

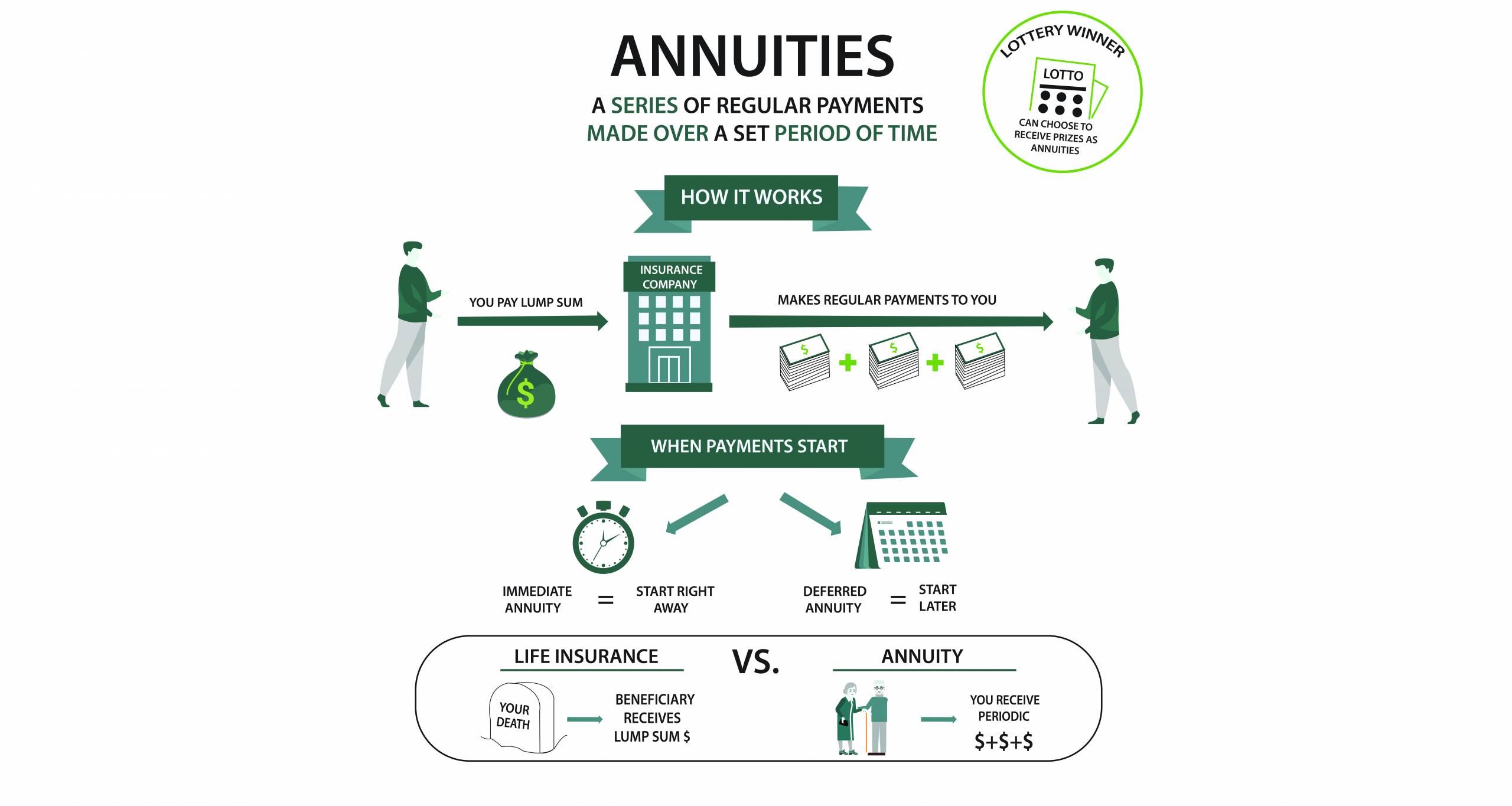

What Is An Annuity How Does An Annuity Work For Retirement

Annuity Beneficiaries Inheriting An Annuity At Death 2022

Taxation Of Annuities Explained Annuity 123

How To Avoid Paying Taxes On An Inherited Annuity Smartasset

What Is An Annuity Rates Types Pros Cons

Do I Have To Pay Taxes On An Inherited Annuity Mastry Law Estate Planning

What Is An Annuity Pendo Insurance Servicespendo Insurance Services

Publication 575 2021 Pension And Annuity Income Internal Revenue Service

Common Tax Traps Involving Nonqualified Annuities Gwa Blog

Helping An Annuity Beneficiary Understand Distribution Options Wealth Management

How Are Annuities Given Favorable Tax Treatment Due

Annuity Taxation Fisher Investments

Do Annuities Have Beneficiaries